9th September 2025 – Swedish Depository Receipts (SDR) Offering. Below you will find details of the Offer and access the associated documents.

The Offering

Offering: The offer to the general public in Sweden and to institutional investors in Sweden and internationally to purchase Swedish Depository Receipts (“SDRs”) in connection with the planned listing on Spotlight Stock Market (“Spotlight”)

SDR: One (1) SDR represents one (1) share in the Company

Trading ticker: ZENA SDR

Subscription price: SEK 0.45 per SDR

Issue volume: The Offering comprises a maximum of 55,555,556 SDRs representing 55,555,556 new shares, equivalent to approximately SEK 25 million before issue costs

Subscription period*: September 9 – September 23 2025

Minimum subscription entry: 4,500 SDRs, corresponding to SEK 2,025

* Subscription through Avanza closes on September 22 2025 at 23:59 CEST

Background and Motive

Zenith Energy Ltd. (“Zenith” or the “Company”) is focused on near-term cash flow and long-term scalable growth across natural gas and solar energy. The Company operates gas-to-power and royalty-based production assets in Italy and the United States, generating stable revenue with low operational risk.

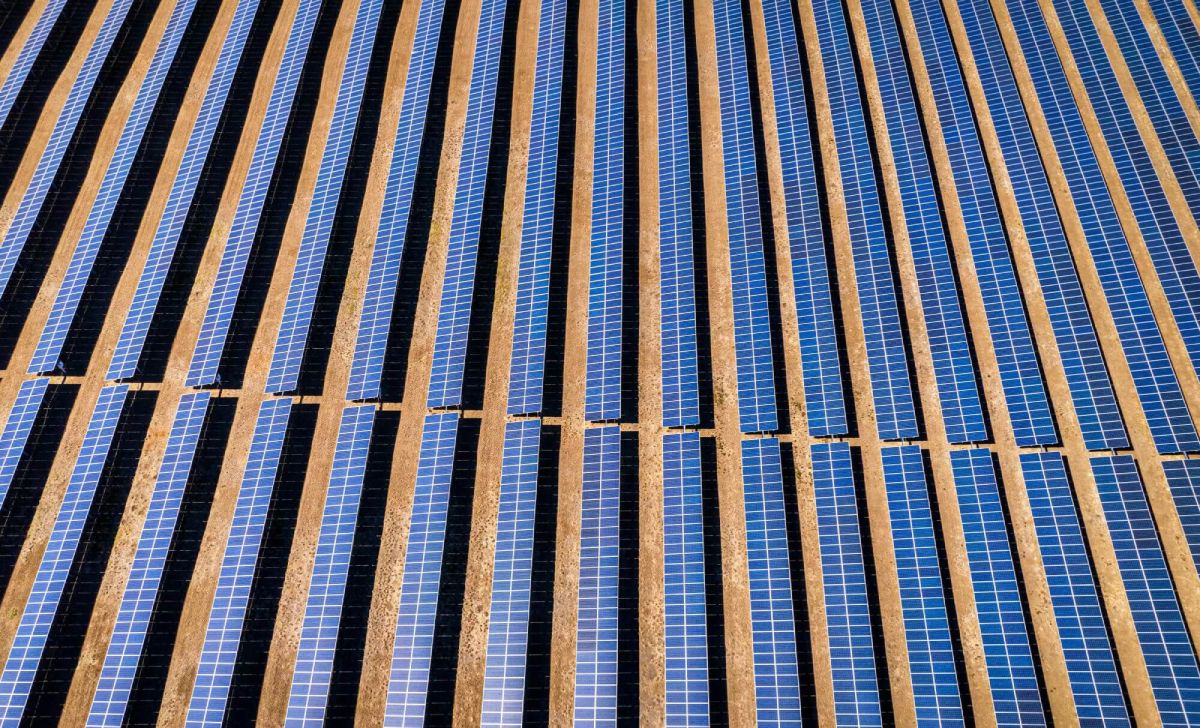

A core strategic priority is the expansion of the Company’s solar energy portfolio in Italy through its wholly owned subsidiary WESOLAR S.R.L., where supportive regulation and high electricity prices enable attractive project economics. At the same time, Zenith is developing selected low-capex gas concessions in Italy, including Masseria Grottavecchia and Torrente Cigno.

Zenith is also engaged in international arbitration proceedings against the Republic of Tunisia regarding its energy production portfolio in Tunisia. While the timing and outcome of the arbitration proceedings remains uncertain, a favourable award could represent a material financial upside and provide additional capacity for growth investments.

Through the Offering and the subsequent listing on Spotlight, Zenith aims to strengthen its presence in the Swedish market. Sweden offers a dynamic and growing base of engaged retail investors, where the Company is already visible. The listing is expected to increase awareness, broaden the shareholder base, and support Zenith’s continued growth – both in terms of operations and investor engagement.

Use of Proceeds

Proceeds from the Offering will primarily be used to support the execution and acceleration of the Company’s strategic initiatives, including:

- Development and expansion of solar energy projects in Italy, such as the Ligurian project, the Puglia project and the Piedmont acquisitions.

- Strengthening working capital and supporting potential acquisitions or project scale-up.

Timetable

September 9 – September 23 2025: Subscription period for the Offering

September 24 2025: Announcement of the outcome of the Offering

September 30 2025: Settlement date

October 10 2025: Expected first day of trading on Spotlight